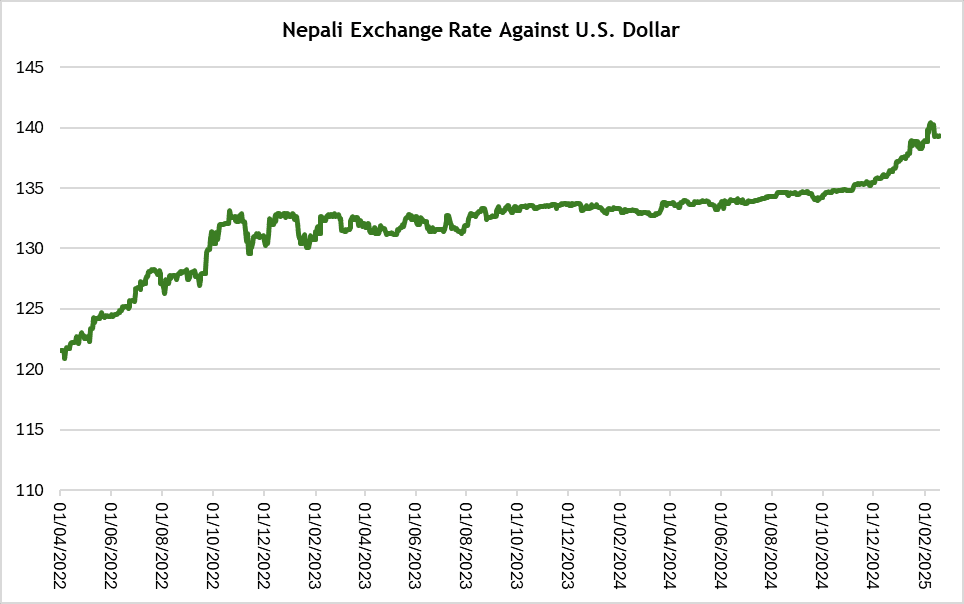

Until June last year, the U.S. dollar was some 134 Nepali rupees. This February, the dollar exchange rate surged to another record high, strengthening by almost six rupees in a span of eight months — an appreciation of approximately 4.5%.

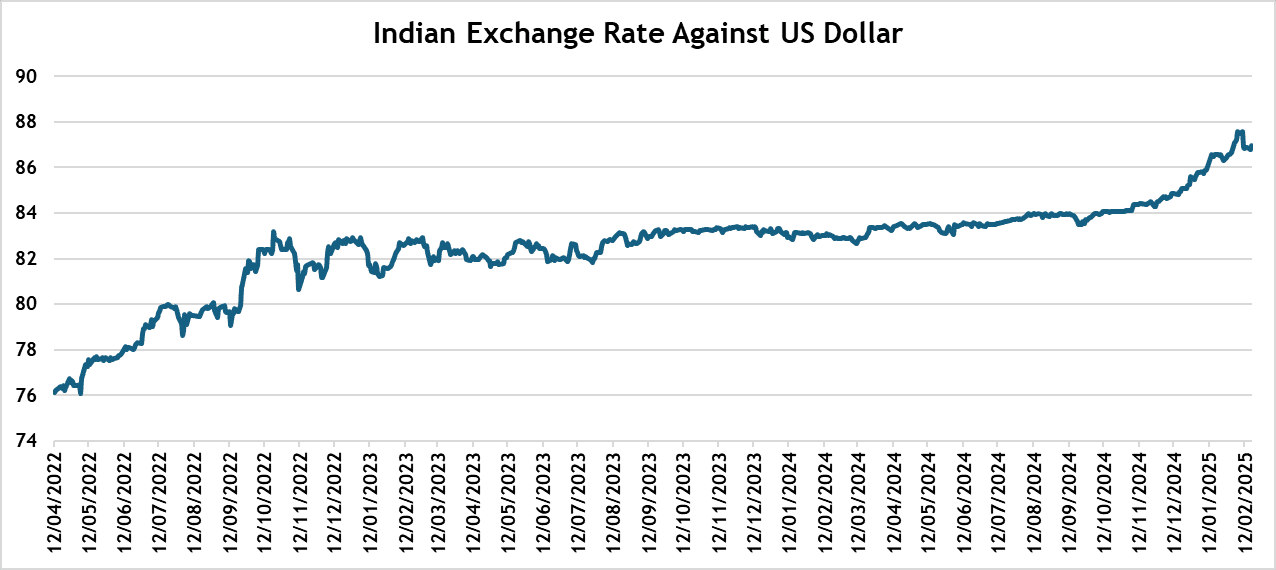

This has happened after the Indian rupee, against which the country’s currency is pegged at a fixed exchange rate [1 INR = 1.6 NRs] for the last 32 years, plunged to record lows against the dollar.

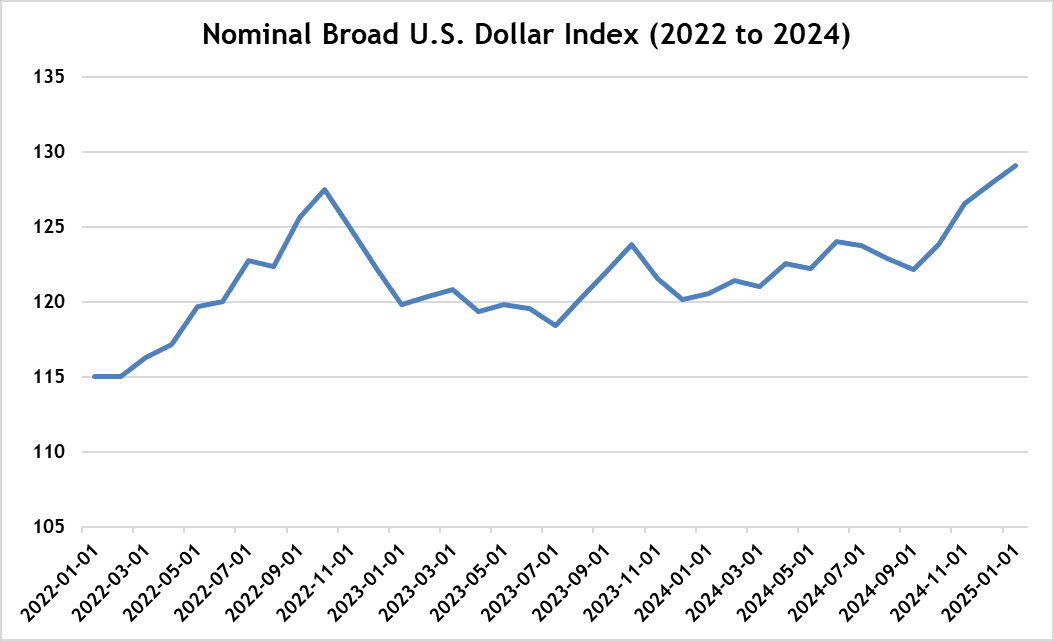

The dollar index, a while ago, reached as high as 109 in January sliding to 107 in February when the rupee fell to around 87 in the first week of February.

A strengthening dollar means Nepal faces rising import costs, inflationary pressures, shifting remittance inflows and rising costs in servicing its external debts.

How does Nepal's foreign exchange work?

The NRs is not directly linked to the U.S. dollar and is not freely floated. Instead, it is pegged to the Indian Rupee (INR), meaning its value is directly influenced by the performance of the INR in the foreign exchange market rather than the U.S. dollar.

Smaller economies often peg their currencies to those of larger nations to maintain stability, as they typically lack the foreign exchange reserves needed to manage a free-floating currency in global markets. And Nepal did so with INR because India is also its largest trading partner.

The Nepalese Rupees was pegged to the INR in 1983 and the exchange rate was officially set to 1.6 NRs in 1993.

Source: Reserve Bank of India

Source: Nepal Rastra Bank

How rising exchange rate drags the country’s economy?

The U.S. dollar has been on a steady rise for a while now.

As a largely import driven economy, its most noticeable and hard-hitting effect is observed in rise in import costs transmitting as high prices for producers and average consumers alike.

The recent six months data compiled by the Nepal Rastra Bank (NRB) shows that out of the country's total import of 822.37 billion rupees, the share of intermediate goods is 50.2%, capital goods is 8.8% and final consumption goods is 41%.

Such distribution indicates that the impact of rising import costs transmits across all categories of goods — from petroleum, agricultural inputs such as chemical fertilisers and tractors to essential goods such as food products.

Even though the country primarily trades with India and conducts transactions in their currency, for which it holds substantial reserves of the IC, the price effect is bound to occur. The reason: depreciating Indian Rupees against the dollar, which will affect commodity prices in India as well, subsequently influencing import costs for Nepal and its overall inflation.

Presently, the country’s inflation [until second quarter] is 5.41%. While food prices have grown by 7.67%, among which vegetable prices have inflated by 29%.

A recent paper says that fluctuation in currency exchange rates significantly impacts consumer prices—specifically when domestic currency depreciates. The study finds a significant exchange rate pass-through to consumer prices for up to 12 months meaning that while this effect doesn’t happen instantly—it can take time for price changes to be fully reflected in the economy, sometimes lasting up to a year.

With the NRs on a steady decline since 2020/21 [or, INR for the matter of fact], this latest dollar rally is set to add fuel to inflationary pressures and sooner than expected since the ongoing appreciation is not by some small margin.

Exports, on the other hand, stand to benefit from the surge in dollar as it makes local products cheaper and more competitive in the foreign market. But this advantage can be offset by increasing production costs. Additionally, gains in exports may be limited to a few commodities only as Nepal largely exports to India followed by China, both in their respective currencies.

Apart from a stark increase in 2021/22, exports have decreased in the year afterwards falling to 157.14 billion rupees in 2022/23 and then to 152.38 billion rupees in 2023/24.

This fiscal year, exports have increased by 32% to 98.79 billion rupees in the last two quarters. But the growth is largely driven by soybean oil accounting for 19% of the total exports, of which over 90% is sold to India.

In the light of such trends, Nepal doesn’t seem to be benefitting in the exports domain either from the dollar surge.

The IT sector however appears to be gaining with the dollar appreciation. Unlike other industries, their exports aren’t affected by cost pressures such as rise in the prices of intermediate or final goods as they rely more on digital services. This advantage could help the sector boost their exports value in the near future too.

A recent study shows that Nepal exported IT services worth $515 million in the fiscal year 2022/23, growing by 64% from 2021/22.

Additionally, the NRB data shows that exports of telecommunication, computer and information services showed a stable rise in 2022/23 and 2023/24 which preceded a decline during the COVID. It already amounts to 10.5 billion rupees in the first two quarters of the ongoing fiscal year.

With the growing IT exports potential, the government has also set an ambitious IT export target—three trillion rupees by 2034/35. Earlier, it reduced the threshold for foreign direct investment (FDI) in the sector. The country is also taking stronger measures to position itself as an attractive destination for FDI in other sectors of the country.

With the NRs on a steady decline since 2020/21, this latest dollar rally is set to add fuel to inflationary pressures and sooner than expected since the current appreciation is not by some small margin.

A depreciating currency however alarms foreign investors as it reduces the value of profits when large Nepaleses rupees would be required to convert into dollars, making investments less attractive, and possibly keeping them at bay.

| Year | Import (In Rs) (In billions) | Exports (In NRs) (In billions) | Inflation | Food Inflation |

| 2020/21 | 1,540 | 141.12 | 3.6 | 5.0 |

| 2021/22 | 1,920 | 200.03 | 6.3 | 5.7 |

| 2022/23 | 1,612 | 157.14 | 7.7 | 6.6 |

| 2023/24 | 1,593 | 152.38 | 5.4 | 6.5 |

| 2024/25* | 822 | 98.79 | 5.4 | 7.7 |

Meanwhile, other effects will be immediate. For instance, financial strain while servicing the country’s external debt, which has surged to 1.30 trillion rupees (50.41% of the country’s total outstanding debt) by the end of the second quarter.

A large external debt and depreciation of the home currency will make the debt repayment of its bilateral and multilateral creditors expensive. This means the country’s treasury will now have to shell out extra NRs to pay its dollar-denominated debts. If the NRs keep weakening, the country will have to dip into its dollar reserves more frequently to manage the increased cost of servicing its debt.

A four year trend since fiscal year 2020/21 shows an increasing debt servicing cost for the country— growing by over 15% annually. In the same time period, it has faced a staggering foreign exchange loss of almost NRs 50 billion due to its weakening currency.

A large external debt and depreciation of the home currency will make the debt repayment of its bilateral and multilateral creditors expensive. This means the country’s treasury will now have to shell out extra NRs to pay its dollar-denominated debts. If the NRs keep weakening, the country will have to dip into its dollar reserves more frequently to manage the increased cost of servicing its debt.

A four year trend since fiscal year 2020/21 shows an increasing debt servicing cost for the country— growing by over 15% annually. In the same time period, it has faced a staggering foreign exchange loss of almost NRs 50 billion due to its weakening currency.

A depreciating currency however alarms foreign investors as it reduces the value of profits when large Nepaleses rupees would be required to convert into dollars, making investments less attractive.

One of the few and strongest positives coming out from the stronger dollar has been an increased remittance receipt.

This is best represented by a staggering growth in remittance in fiscal year 2021/22 and 2022/23 when the receipt in dollars in both years increased by over a billion dollars [see table below]. This coincided with a period when the dollar surged drastically from 118.2 in 2020/21 to 131 in 2022/23 [in average] [see graph below].

However, in the last six months, remittance receipt increased by only 4.1% to NRs 763.08 billion compared to the previous fiscal year. The growth is too modest when compared to an increase of 22.2% in the same period the previous year. In dollar value, remittance increased by 1.1% to $5.58 billion in the review period compared to an increase of 19.5% in the previous year.

The last four year data paints a contrasting picture of a surging and diminishing growth. Although the country could still benefit from favourable exchange rates, shifting socio-economic and financial conditions of remittance senders may disrupt this steady inflow. Additionally, the country is already excessively dependent on remittance, which may eventually hit a saturation point.

In this regard, the government’s latest initiatives to streamline labour migration to official agreement, including one with Israel to send 2,112 caregivers, reflect its unwavering focus and reliance on labor migration. This also suggests that remittance inflows are likely to keep rolling alongside the surge in the dollar rates.

Others, such as Nepali tourists and migrating students, may not share the same enthusiasm about the dollar appreciation. A total of 11,261 Nepali students received study permits to study in the U.S. in the last fiscal year 2023/24, according to data from the Ministry of Education. For them the cost of their travel and education will drastically increase with dollar's appreciation.

| Year | External Debt | Remittance | Remittance (In $) | Total Debt Servicing | TCI** Services |

| 2020/21 | 9.4 | 961 | 8.2 | 29.4 | 16.1 |

| 2021/22 | 10.3 | 1,007 | 8.3 | 36.9 | 14.5 |

| 2022/23 | 11.7 | 1,221 | 9.3 | 42.9 | 15.6 |

| 2023/24 | 12.5 | 1,445 | 10.9 | 50.0 | 15.5 |

| 2024/25* | 13.0 | 763 | 5.6 | 27.2 | 10.5 |

Source: PDMO Annual and Quarterly Reports, NRB Current Macroeconomic and Financial Situation | *data till first six months of 2024/25 | All figures are in NRs billions except mentioned otherwise | **TCI: Telecommunication, computer & information services

Photo caption: A dollar would cost some NRs 98 some 10 years back [in 2013/14]. Since then, it has been growing steadily, with occasional steep growth, just like the recent times | Source: Nepal Rastra Bank | The average exchange rate till February of the current fiscal year. Exchange rates surged to Rs. 140 in February. Month end rate of January was Rs. 137.55

Stronger dollar worries worldwide

The U.S. dollar has remained the central global currency for decades now. Countries worldwide keep dollars in reserve to pay for their trade and manage finances. As of 2022, 54% of the trade happens in dollars.

This dollar has surged significantly since mid-2021 owing to a series of global crises — beginning from the pandemic to the Russia-Ukraine war, exerting a powerful influence on global markets and economies. Its appreciation means international trade, largely conducted in dollars, becomes expensive, posing challenges for the countries worldwide. One key concern arises from food prices which are traded in the global market in dollars. Another in the ability of different countries to do trade.

Source: FRED

The broad dollar index measures the value of the dollar relative to a wide range of trading partners including emerging markets. A nominal index does not account for inflation between countries.

A new study reveals that a stronger dollar stifles economic growth in emerging nations, creating widespread financial strain and slowing progress.

“Since 1980, cycles of U.S. dollar appreciation have been accompanied by slower global economic growth, with the negative correlation most pronounced for emerging and developing economies (EMDEs). This time is no different”, says the study [The research considers EMDEs, which doesn’t include Nepal].

Going by the present uncertainty, one central issue is how countries will manage their economies in a turbulent landscape as the dollar shows little signs of stopping.

Under the new Trump Administration which began its tenure just a month ago, the US is now an inward-looking protectionist regime — a dramatic departure from the open trade policy it propagated to the world for decades. While it threatens countries engaging in trade in currency other than dollars to look no other way or face exorbitant tariffs.

Although Trump reportedly prefers a weaker exchange rate, his advent into the US presidency already began strengthening the dollar instead. While his tariffs that Trump has so vociferously announced against several countries are certain to make imports expensive in the U.S., which means fewer dollars leave the country, decreasing its supply in the global market and further appreciating the dollar. Meanwhile, the ever-changing realities of geopolitics continue to make economies worldwide volatile and anxious. Dollar is expected to continue to be the top choice of the global financial players.

Read More Stories

Kathmandu’s decay: From glorious past to ominous future

Kathmandu: The legend and the legacy Legend about Kathmandus evolution holds that the...

Kathmandu - A crumbling valley!

Valleys and cities should be young, vibrant, inspiring and full of hopes with...

A week into Israel-Iran conflict

The latest escalation between Israel and Iran has entered its eighth day. Heres...