Economic instability | Central bank | Monitoring

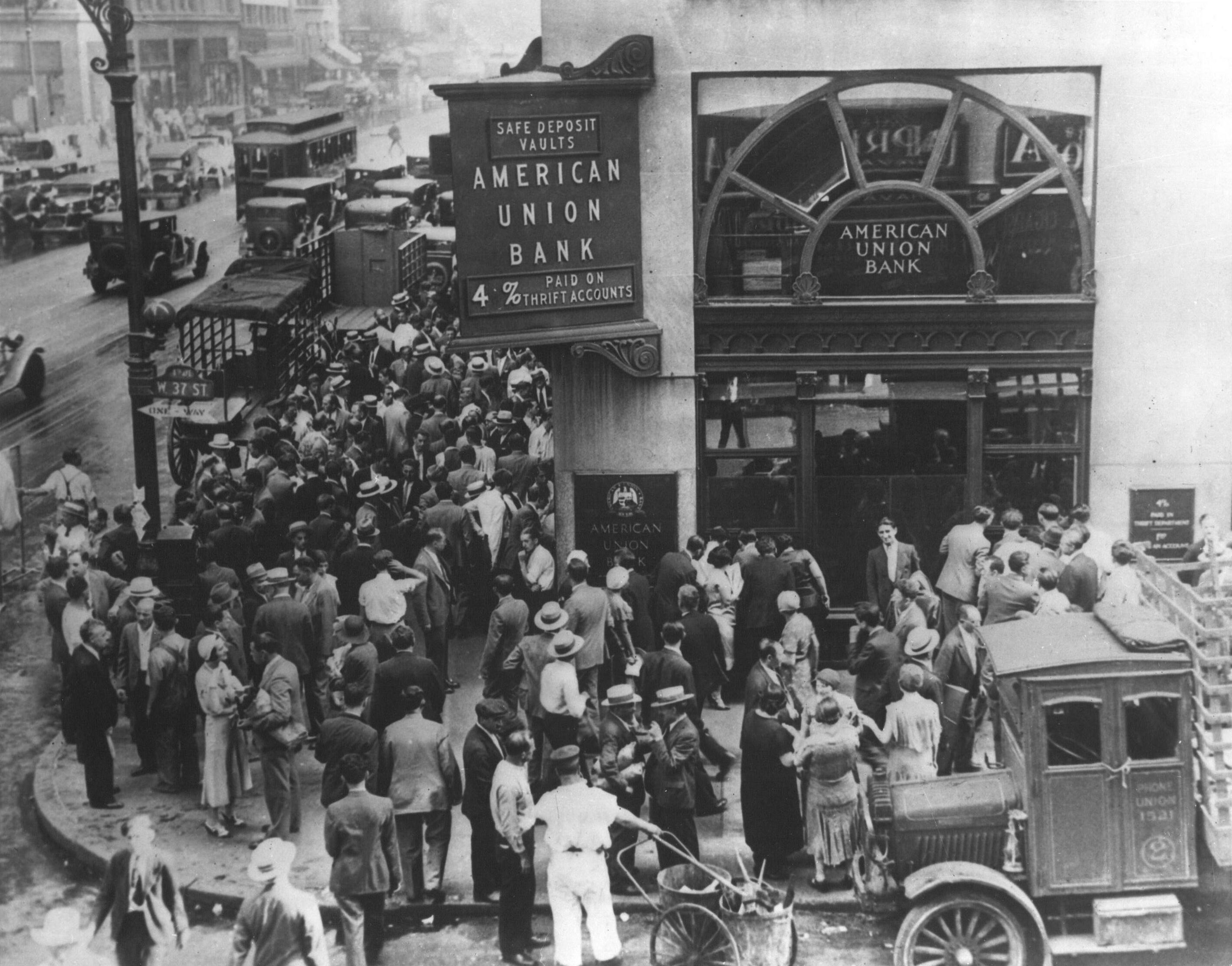

A bank run occurs when a significant group of depositors, all attempt to withdraw their money at the same time with a concern that their bank might not be able to refund it fully and promptly.

Bank runs are typically driven by fear and panic triggered by various factors — rumours about the bank’s financial health, news of other bank failures, economic instability, or a loss of confidence in the banking system as a whole.

As the banks function under the fractional reserve system, which only holds a portion of deposits in cash or in conveniently accessible forms, with the remainder being leased to borrowers or used to purchase other interest-bearing assets like government securities, even a financially stable bank may have trouble processing withdrawal requests during a bank run.

Earlier in March marked the largest bank run in history — USD 42 billion — which led to the closure of Silicon Valley Bank.

A bank must swiftly raise its cash reserves during a run to satisfy depositor demands, primarily by selling assets, often hastily and at fire-sale prices. As banks hold little capital and are highly leveraged, losses on these sales can drive a bank into insolvency.

Government and central banks play a pivotal role in preventing bank runs and maintaining financial stability. They may step in by introducing laws to monitor and oversee the banking industry, deposit insurance programs to reassure depositors, and emergency liquidity support to banks.

Read More Stories

Kathmandu’s decay: From glorious past to ominous future

Kathmandu: The legend and the legacy Legend about Kathmandus evolution holds that the...

Kathmandu - A crumbling valley!

Valleys and cities should be young, vibrant, inspiring and full of hopes with...

Israel attacks Iran’s nuclear and military sites, Iran retaliates with drones

In a latest escalation in West Asia, Israel targeted nuclear and missile facilities...